Finding the right accounting and finance software for your business can be a challenge. This guide explains the obstacles businesses face when they don’t adopt cloud-based technology and instead rely on legacy systems. The bad is that, if left unchecked, obsolete systems are costly to support, lacking common features and advanced functions, and increase security risks as bug-fixes and patches are no longer made. The ugly is that, in the event of a disaster, older systems make it very difficult to recover critical data. But let’s not forget the good. Here, you will learn about some of the most popular cloud accounting software used today that streamlines business accounting, operations, and finance with secure access remotely from anywhere you work.

The Easy Way for SMBs to Manage Finance and Accounting

Microsoft Dynamics 365 Business Central is among the most popular cloud-based services for taking your financials, sales, services, and operations to the next level. Business Central, for example, provides the following accounting and finance benefits:

1. Streamline Your Accounting

When companies use Dynamics 365 Business Central Accountant Hub, they can manage accounting tasks and transactions with an easy-to-use dashboard. Our experts know the importance of your accounting system. We recommend replacing any legacy accounting system with cloud-based accounting to improve efficiency by saving you time and money.

2. Better Financial Management

Unite your accounts, refine financial forecasts, and automatically update opened and closed accounts with a complete overview of your business in a single place.

3. Enhanced Operations

Take your manufacturing and warehousing operations to greater heights by reducing costs with sales forecasting and automated out-of-stock functions that generate product alerts when user orders deplete your inventory of an item to zero or a predetermined level.

4. Secure Supply Chain Automation

Achieve greater control over your buying process to ensure you only make financial actions when needed, have better inventory control, and inventory numbers that reflect your stock in real-time. In return, this helps you better meet customer demand and/or inventory needs of various departments in your company.

5. Improve Customer Service

Dynamics 365 Business Central also allows you to easily track customer interactions and identify the best moments for up-sell, cross-sell, and renewal in your sales process. This can bring important sales opportunities to the right people sooner.

6. Meet Project Deadlines and Under Budget

Dynamics 365 Business Central allows you to manage budgets and monitor project progress with real-time data and business insights. Additionally, you can easily compare customer invoices with quotes to make smarter buying and selling. Some of the services most commonly-used metrics include profitability and resource-usage.

Dynamics 365 is Better for Remote Workers

If your company or organization has accounting or finance employees who work remotely, Dynamics 365 and Microsoft 365 can easily let them work with everyone through the same cloud-based software on nearly any device. The latter includes chat, video conference, voice call, and other features in Microsoft Teams.

The integration with other Microsoft cloud software includes Word, Excel, and other common programs companies have used for decades. This integration also breaks down any barriers between siloed programs used for accounting, finance, and operations by making it easier to share info between departments.

The Fall of Legacy Software. The Rise of Cloud Tech.

Switching from a legacy system to a cloud-based platform such as Business Central for accounting and finance is an easy transition for any business. The first thing we look for in this process is software compatibility.

We will help you transfer customer or client files and assist with trainings. Businesses find that migrating to cloud tech provides digital security, mobility, and flexibility that previously didn’t have in today’s world.

Business Central is ideal for SMBs, who want an easier or more modern way to manage their finances and accounting. Generally, this software allows a company to connect their finance, accounting, service, and sales operations with one platform rather than spending hundreds or thousands of dollars on siloed softwares for each department. This consolidation also prevents single points of failure by creating multiple access points for your business systems.

We call this process “legacy modernization,” which simply means updating your business systems to better support your goals. In our case, we look at updating obsolete software with all-in-one cloud-based solutions. So, does your business fall under this category? Well, here’s what you need to consider.

Typically, businesses have a mix of new and old software for finance and accounting. However, it’s not uncommon for some people to use outdated systems and software. A more clear definition for “old” is something from the early 2000s or older. Anything from the last few years is exempt from this, usually. One of the exceptions is specifically with accounting software, where a legacy system doesn’t have to be considered “old” in order for it to be inefficient and a burden on your processes.

For accounting, legacy can be any piece of software, tech, or system that hinders your company’s ability to swiftly adapt to dynamic market conditions. The good news is that if it’s a software you’re concerned with, it can usually be integrated into a modern system like Business Central. In our experience, most people look toward legacy modernization, when legacy systems fall short in user experience, security, customer support, or lack future-proof updates.

Risk and Reward of Legacy vs. Modern Software

It’s a financial investment to upgrade your business to modern finance and accounting software, but sticking with older systems creates more liability and often costs you more in the end. Here are some of the other advantages of using Business Central as your go-to ERP solution:

- Reduced license costs for Business Central versus other softwares, which may incur additional costs from adding users, servers, hardware upgrades, electricity, heating/cooling, and IT maintenance.

- Reduced security costs. Generally, unpatched and/or unsupported legacy software may leave your business open to malware and cyber attacks. Ultimately, this could cost your business millions in damages.

- Forgo ongoing maintenance costs of upgrades. Microsoft provides a Business Central upgrade every six months.

- Business Central features automation, which saves costly hours doing day-to-day tasks by hand.

Here are some common questions to ask yourself to help determine whether it’s time to modernize your accounting and finance software with Business Central:

- Are you a small- or medium-sized business?

- Has your company’s growth outscaled your current accounting or finance systems?

- Is your company using automation for those systems?

- Do you consider your company’s current system flexible and customizable?

- Is data and cybersecurity important to your business growth and development?

If you answered yes to any of these questions, Business Central is likely the right cloud-based solution for your business.

Microsoft Dynamics GP: The Common Legacy System

A common legacy cloud system for accounting and finance is Microsoft Dynamics GP, which is a mid-market business and enterprise resource planning (ERP) solution. Today, this system has become outdated in comparison to other systems such as Business Central. Dynamics GP was the result of Microsoft’s research and development into creating affordable accessible software for small- and medium-sized businesses (SMBs). The goal was to help SMBs compete with some of their larger competitors with efficient ERP solutions. At the time, this leveled the playing field by giving SMBs the same advantages and capabilities of some of the most expensive ERPs used by big companies. However, there are simply better options for accounting and finance, especially for small- and medium-sized businesses.

The heart of Dynamics GP was created with small and growing businesses in mind. We know you have a business to run, and part of that is having affordable, efficient tools to do so. That’s why we now recommend Business Central as the go-to ERP software for businesses for integrated cloud-based technology to access files, apps, data management, and devices. Business Central also allows managers and executives to focus on running and growing their businesses instead of trying to make sense of outdated accounting and finance systems.

Business growth and scalability is difficult with the right tools and data in hand, and the last thing you want to do is lose your best customers to your competition because you didn’t have access to the real-time data provided by cloud-based services like Business Central.

Regarding, business scalability, Business Central makes it easy to scale to any business size in the blink of an eye. This eliminates any growing pains with growing your users for applications your business regularly uses.

Business Central also provides a holistic approach to accounting and finance management, including:

- Improved financial accounting and management

- Full inventory management and controls

- Sales management and reporting

Business Central folds legacy application use into a single solution for all of your accounting and finance needs.

What Happens After Legacy Modernization

Business growth typically comes with finance-related challenges. Whether it’s keeping up with market trends, managing cash flow, or exploring new markets, you need a reliable system that can be scaled and kept current without breaking the bank.

Like their legacy ancestors, cloud-based systems are not exempt from software updates. However, updating is a painless process when using cloud-based systems. Like the apps you use on your phone, upgrades come automatically with new features and improvements.

Don’t underestimate the simplicity of this though. Upgrading your legacy system to a modern ERP can be easy with the right solutions partner. It’s a valuable goal for any business to tackle if they want to stay competitive with technology and remain relevant in their respective markets.

Using Modern Systems to Beat Your Competitors

It’s like any race. Keep up or be left behind. This is especially true for SMBs that compete directly with big box stores or large corporations.

ERP systems like Business Central make it possible to share the same ground with similar-sized businesses and the heavy hitters. SMBs can do this by leveraging real-time customer data and other business insights provided by cloud-based systems.

In Business Central, SMBs can view performance data via customized reports and dashboards to make smarter business decisions. This better equips them to improve customer experience, loyalty, and lifetime value (LTV) of their best customers.

Some of the most common pain points for SMBs include thin profit margins, budget constraints, time-consuming manual processes, and siloed positions. Business Central alleviates some of these time constraints by making all data available in a centralized location with build-in automation, insights, and reporting.

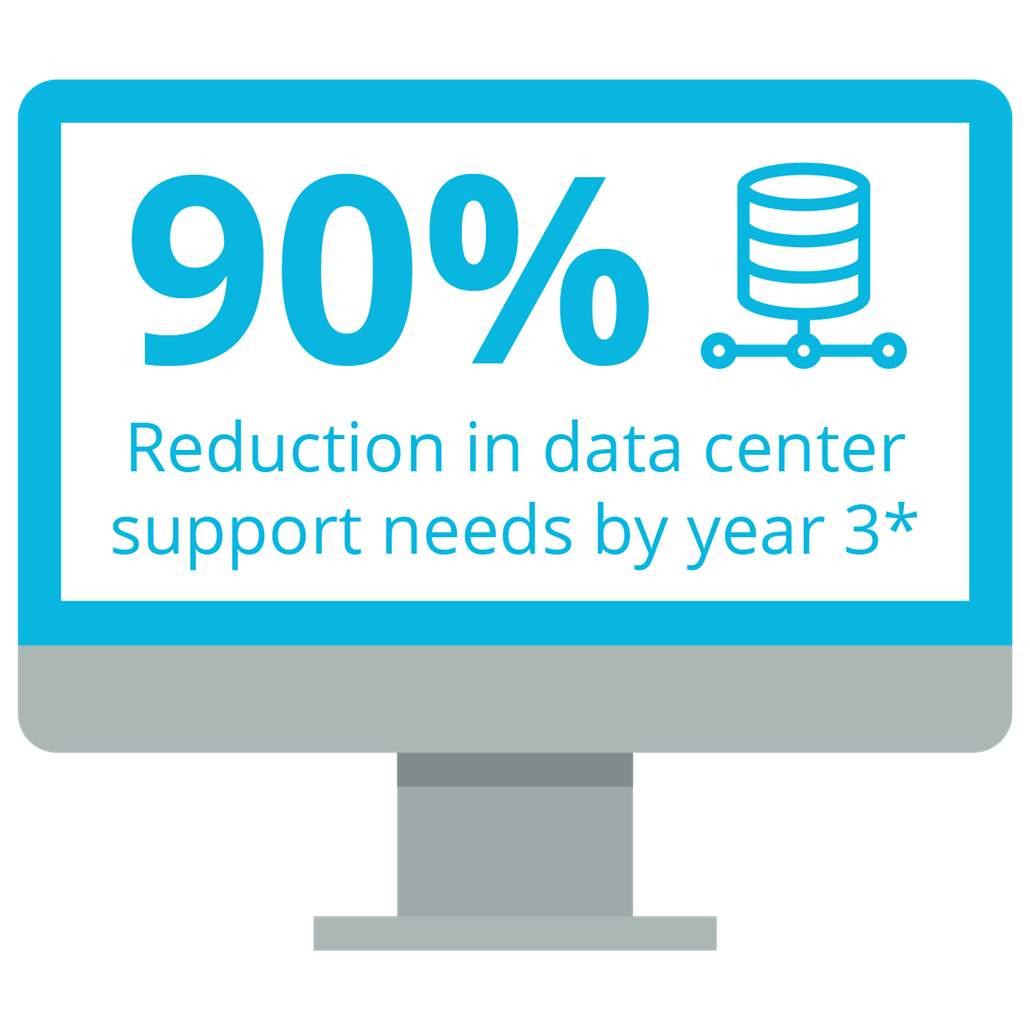

Minimizing the Impact of Modernization on Your Business

A majority of the work toward adopting a cloud-based solution for accounting and finance services means getting rid of current infrastructures used to maintain them. You immediately save money by not spending resources managing onsite hardware and servers. You can forget about installation and maintenance fees or surprise costs when something goes wrong.

The big picture is you don’t worry about faulty hardware or data loss. And in the event of an emergency that could wipe out your vital business data, Microsoft provides a variety of disaster recovery options best for your business.

If people at your business are resistant to change, you explain to them the benefits of cloud-based technologies. Software such as Business Central allows them to adapt faster to changes in their work and be more efficient with automated processes.

Contact the experts at 360 Visibility if you’d like to learn more about using cloud-based software to automate your business accounting and finances.

Accounting & Finance Software Resources

The Future of Financial Services Is in the Cloud

The Evolution of the Role of the Forensic Accountant in International Investigations

Should I Stay or Should I Go? What It Means to Move Your Firm to the Cloud